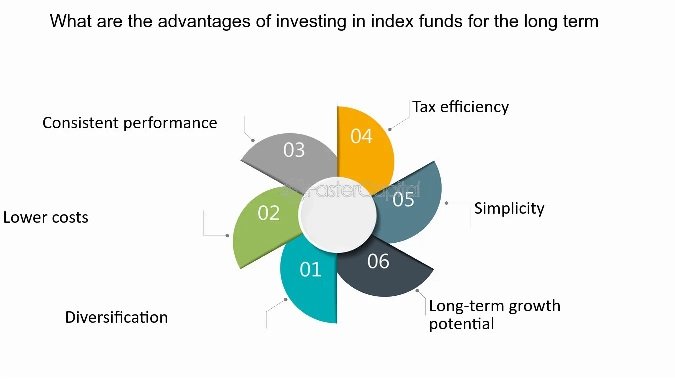

Have you ever wondered why index funds are so popular among investors with long-term goals? What makes them a reliable choice for building wealth over time? Investing in passive equity portfolios is often seen as a simple yet powerful strategy for growing your portfolio. In this article, we’ll explore the long-term benefits of investing in these funds and why they’re a smart option for anyone looking to build wealth steadily.

Low Costs

When you invest in mutual funds, particularly index funds, you realize their advantage is their low cost. But why are they cheaper than other types of investments? The answer lies in their passive management style. Unlike actively managed funds, passive equity portfolios don’t require managers to constantly buy and sell stocks, reducing transaction costs. Lower management fees mean more of your money goes toward growing your investment.

Why Low Costs Matter:

- Reduced fees: Index funds typically have lower expense ratios than actively managed ones, leaving more for you to invest.

- Less turnover: Fewer trades mean fewer capital gains taxes, which can reduce your overall tax bill.

- Higher net returns: Over time, the savings from lower costs can add up, significantly affecting long-term growth.

Diversification and Risk Management

Diversification is a significant advantage of index funds, as it allows you to spread your investment across numerous companies and sectors rather than relying on just one. Investing in a broad range of stocks keeps the overall performance balanced, even if certain companies or sectors perform poorly. This reduces the impact of market volatility, as stronger performers can offset weaker ones, ultimately managing risk more effectively. Over time, diversified portfolios offer more excellent stability and deliver more consistent returns than individual stocks, making them safer for long-term investors.

Consistent, Long-Term Growth

Many investors turn to index funds for their potential to deliver consistent growth over time. Historically, stock markets have shown an upward trend, and passive equity portfolios benefit from this general market growth. While there may be short-term fluctuations, the long-term performance typically mirrors the broader market, which has historically delivered solid returns.

Why Index Funds Promote Growth:

- Market tracking: Since index funds track the overall market, they tend to grow steadily over the years, even if there are temporary dips.

- Compounding returns: Reinvesting dividends and capital gains allows your investment to grow accelerated over the long term.

- Peace of mind: Investors can focus on long-term goals without worrying about daily market fluctuations.

Simplicity and Ease of Use

Another critical advantage of index funds is their simplicity. For those who prefer not to manage their portfolios actively, these provide an easy way to grow wealth. Index investing offers a hands-off approach, unlike active trading, which demands constant attention and expertise.

Once you select your index fund, let it grow without daily oversight. Many brokers also provide the option to automate contributions, making it even easier to stay consistent with your investments. You don’t need to be a financial expert to benefit from this method, as index funds are designed to be simple and accessible for all investors.

How to Get Started with Index Funds

The process is straightforward for those wondering how to invest in index funds. First, decide on your financial goals and risk tolerance. Then, choose a broker or financial institution that offers a range of passive equity portfolios. Select the index that aligns with your investment strategy, whether a broad market index or one focused on a specific sector.

Investing in index funds offers a range of benefits, especially for those with long-term financial goals. Whether you choose to invest in mutual funds or are an experienced investor looking to diversify your portfolio, index funds provide a reliable way to achieve your goals with minimal hassle. By focusing on the market’s long-term potential, you can enjoy the rewards of steady growth while managing risks effectively.